A Scam For The Ages

- mcclawcenter

- Dec 14, 2021

- 2 min read

Updated: Dec 14, 2021

The 2021 Identity Fraud Study reveals a daunting new threat to consumers and businesses: identity fraud scams. While total combined fraud losses climbed to $56 billion in 2020, identity fraud scams accounted for $43 billion of that cost. Traditional identity fraud losses totaling $13 billion.

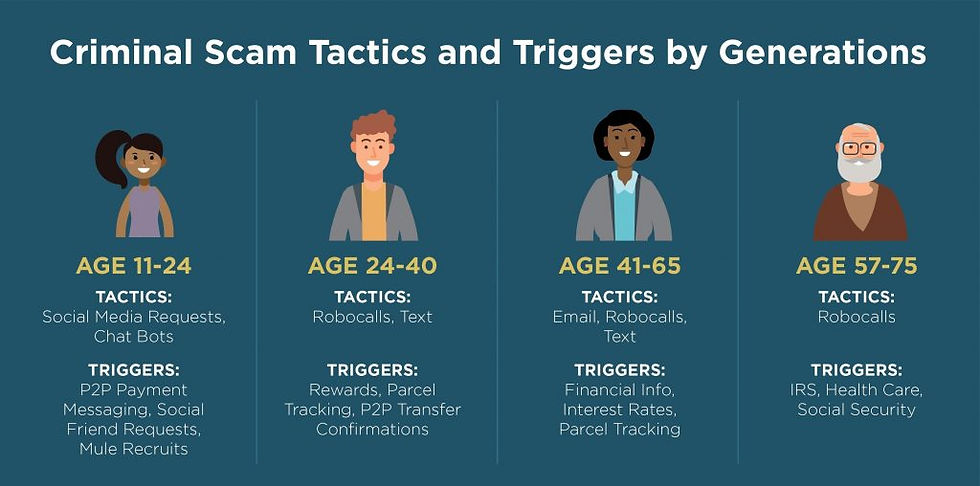

With traditional fraud, consumers often have no idea how their identities were stolen. With scams, they can often tell, upon reflection, the exact moment when they interacted with a criminal via email, phone, or text. With scams constantly evolving, there are always so many different ways a scammer can use to trick someone. Below are a few of the common tactics to look out for.

Debt Collection Scam - Poses as a debt collector for debts that are already paid or that you don't currently owe. Always verify the debt before giving out personal information.

Grandparent Scam - You may get a call from someone that sounds like your relative or family member claiming that they are in trouble and need you to wire or send gift cards as a form of payment.

Imposter Scams - Poses as government official, charity organization or even the town sheriff. Don't always trust your called ID as this can easily be faked. It is best to hang up and directly call the organization to confirm the information asked.

Lottery Prize Scam - "You've won a big prize but you need to make a payment for fees and taxes before claiming." These "prizes" can range from sweepstakes, prize drawings etc. You may receive this through a phone call, mail, email or text.

Mail Fraud - Although these letters may look legitimate, the promises made are fake. Don't send out personal information or money if they're promising to send you something back later.

Comments